- Information

- iGambling

- Blask

- prev

- next

Gambling regulation

-

Online casino:Regulated

-

Online sports betting:Regulated

-

Gambling in detail:

Population

- Population: 37967209 people.

- Official Language: Polish

- HDI: 0,881

- Salary: $1127

- Poverty rate: 0.8%

- Gini: 28.8%

- The believing population: 86%

- Main religion: Christianity (94.3%)

- Second religion: Atheism (5.6%)

Harmful habits

- Alcohol: 11 litres/year

- Smoking: 24%

Internet

- Internet users: 93.3%

- Mobile Internet: 58.7%

- Landline Internet: 40.2%

- Internet speed: 40.1 Mbps

- Country Top Level Domain: .PL

General information about the country

-

Country name:Poland

-

Code (2-digit):PL

-

Continent:Europe

-

Country level:Tier 2

-

Capital:Warsaw

-

Country area:312685 sq km.

-

Telephone code:48

-

Currency (code):Zloty (PLN)

Geographical features of the country

Administrative division into regions

Voivodeships (16): Warmińsko-Mazurskie, Wielkopolskie, West Pomeranian, Kujawsko-Pomorskie, Łódź, Lublin, Lubusz, Mazowieckie, Małopolskie, Małopolskie, Lower Silesia, Opolskie, Podkarpackie, Podlaskie, Pomeranian, Świętokrzyskie, Silesia.

Features of the country

The present-day territory of the country was partially or fully occupied by the following states: Hunnic Empire, Great Moravia, Holy Roman Empire, Galicia-Volyn principality, Mongol Empire, French Empire, Polish-Lithuanian Commonwealth, Russian Empire, Austro-Hungarian Empire, German Empire.

Poland is washed by the following seas: Baltic Sea.

The following rivers flow through the territory: Vistula, Odra, Warta, Western Bug, Narew, San, Notec, Pilica, Wieprz, Szeszupe, Dunajec, Bubr, Lava, Lusatian Nisa, Wkra, Brda, Prosna, Drwęca, Wisłok, Wda and others.

Poland has the following islands: Usedom, Wolin, Sobieszewo.

Mountains on the territory of the country: Rysy, Sniezka.

Famous caves on the territory of the country: Vielka Sniezna, Visoka - Za Siedmiu Progami, Snieżna Studnia, Czarna, Zimna.

Gambling regulation

-

Online casinos:Regulated

-

Online sports betting:Regulated

Read more about regulation

The gambling market in Poland is one of the most strictly regulated in Eastern Europe. The legislation is based on strict control and clear rules.

The main regulatory decree is the Polish Gambling Act. The licensing authority is the Ministry of Finance. The regulation covers all types of gambling.

Other legal acts:

- Act on the National Tax Administration - defines the rules for conducting audits;

- Tax Criminal Code.

The Gambling Law establishes a state monopoly over online gambling, with the exception of promotional lotteries and betting. In fact, these are the only authorised types of online gambling in Poland.

- Online casinos and lotteries - exclusively under state control - Totalizator Sportowy

- Private operators can only obtain licenses for sports betting, poker tournaments and land-based casinos

- Measures have been introduced to combat illegal operators: site blocking, payment bans, blacklists.

The state monopoly extends to ‘number’ games, cash lotteries, televised bingo and slot machines outside casinos. The only permissible forms of betting are at fixed reception centres and via the internet.

The gambling market in Poland continues to grow despite strict regulations. The key trend is the growing number of online gamblers. This is facilitated by the continuous improvement of the internet infrastructure and the increasing availability of mobile devices.

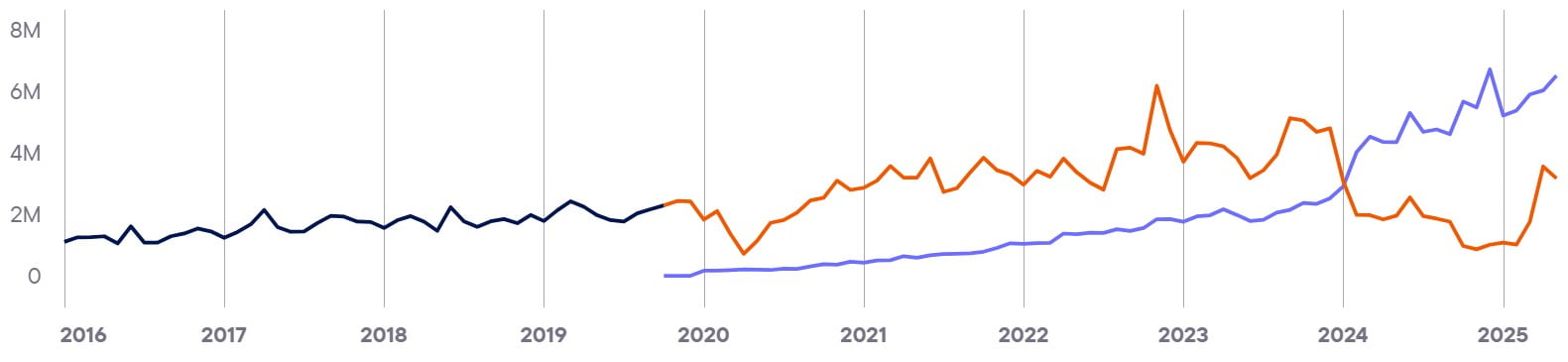

Top brands in the country

Top 5 brands (September 2024):

- 26.2% - STS

- 19.4% - Fortuna

- 8.8% - BetClic

- 6.3% - Lotto

- 5.8% - Superbet

Online Gambling in the country

Slot machines are one of the most popular types of gambling in Poland. Also in demand are:

- online casinos with live dealer;

- scratch cards;

- roulette;

- poker.

46% of Polish residents bet on sports on a monthly basis. At the same time, 31% bet on sports on a weekly basis. This is a high participation rate.

Other participation frequency rates for sports betting are:

- 17% - several times a year;

- 14% - less than once a year;

- 4% - no more than once a year.

The main audience of gambling in Poland is men aged 35-44. 13%-24% of them gamble several times a month.

What motivates players to bet:

- 46% - want to win money;

- 32% - believe that after betting the game becomes more interesting;

- 25% - like the feeling of excitement and impressions;

- 18% - consider it a hobby;

- 17% - want to try something new;

- 10% - make bets under the influence of other people;

- 9% - spend surplus money.

The main motivation of almost half of the respondents is the desire to earn money.

Interesting fact: according to the results of the research for 2020-2021, among 1,119 players, 14% met the criteria of the Severe Gambling Problems Index, 29% - moderate risk, 32.7% - low risk.

Only 24.3% of those surveyed did not exhibit symptoms indicative of gambling addiction problems.

Mobile devices were the most popular gambling platform among Poles of all ages.

Audience Participation:

- 76.09% - participate in sports betting via internet/mobile apps;

- 31.8% - participate in lotteries/gambling;

- 26.5% - have bet on sports in the last 12 months;

- 15.6% - attend sporting events betting online/through apps.

STS is the main and most popular sports betting platform in Poland.

The iGaming market in Poland is one of the most promising and fastest growing in Eastern Europe.

Portrait of a local user

- 53% - men, 47% - women

- 25-44 years old is the main age

- 6 million play on smartphones

- Hits: slots, live casinos, betting, poker

- Younger people are interested in cybersports and live, older people in card games and lotteries

Taxation

- Sports betting - 12% of turnover

- Online casinos - up to 50% of revenue

- Lotteries - 10% of ticket sales

- Poker winnings - 25%

Payments

- 40% - digital wallets

- 30% - bank transfers

- 20% - cards

- 10% - mobile payments

Barriers

- State monopoly restrains the growth of online casinos

- High taxes and complicated licensing

- Strong competition from the gray market

Successful operation in the local market requires:

- Partnerships with local operators

- Focus on mobile solutions, AI and live content

- Compliance with stringent licensing and compliance requirements

The Polish gambling market is losing billions to offshore operators - and there is nothing it can do about it. According to the data announced at the European Economic Congress in Katowice, since 2017, players have lost about €50 billion to illegal operators. The country's budget has lost €1.3 billion in taxes.

Poland cannot stop the leakage of funds. Although large fines and criminal penalties are provided for illegal gambling organization in the country, the rules do not apply to offshore jurisdictions.

Players, on the other hand, risk much more. They can face fines of up to €460 and even imprisonment for up to 3 years for gambling with offshore operators. Therefore, Polish players are not in a hurry to complain about gray operators.

Experts say that as long as the state punishes consumers rather than operators, the shadow market will only grow.

Gambling affiliate programmes that accept traffic from this country

- Blask data from: 06/03/2025

- Population: 38,747,000 people.

- Population growth rate: -1% per year.

- Internet users: 32,300,000 people.

-

Urbanization:

Urbanization — 60.2%

-

Languages in the country:

Polish (official) — 98.2%

Silesian — 1.4%

Other — 1.1%

-

Age structure:

0-14 — 14.2%

15-64 — 65.9%

65+ — 19.8% -

Median age:

Total — 42.9

Male — 41.5

Female — 44.3 -

Literacy:

Total — 99.8%

Male — 99.8%

Female — 99.8%

-

Real GDP:

2021 — $1.527 trillion

2022 — $1.613 trillion

2023 — $1.616 trillion -

Real GDP growth:

2021 — 6.93%

2022 — 5.64%

2023 — 0.16% -

Real GDP per capita:

2021 — $40,500

2022 — $43,800

2023 — $44,100

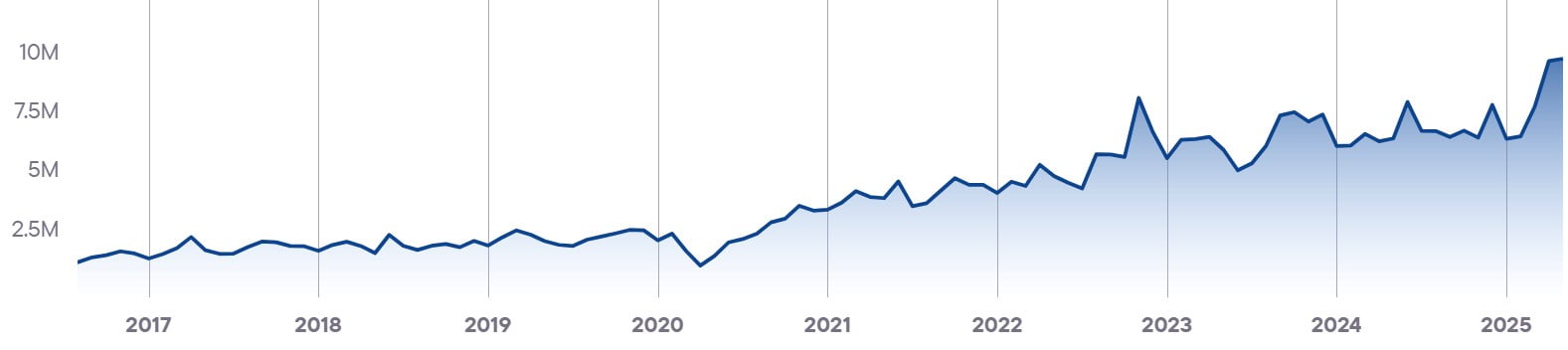

Blask Index

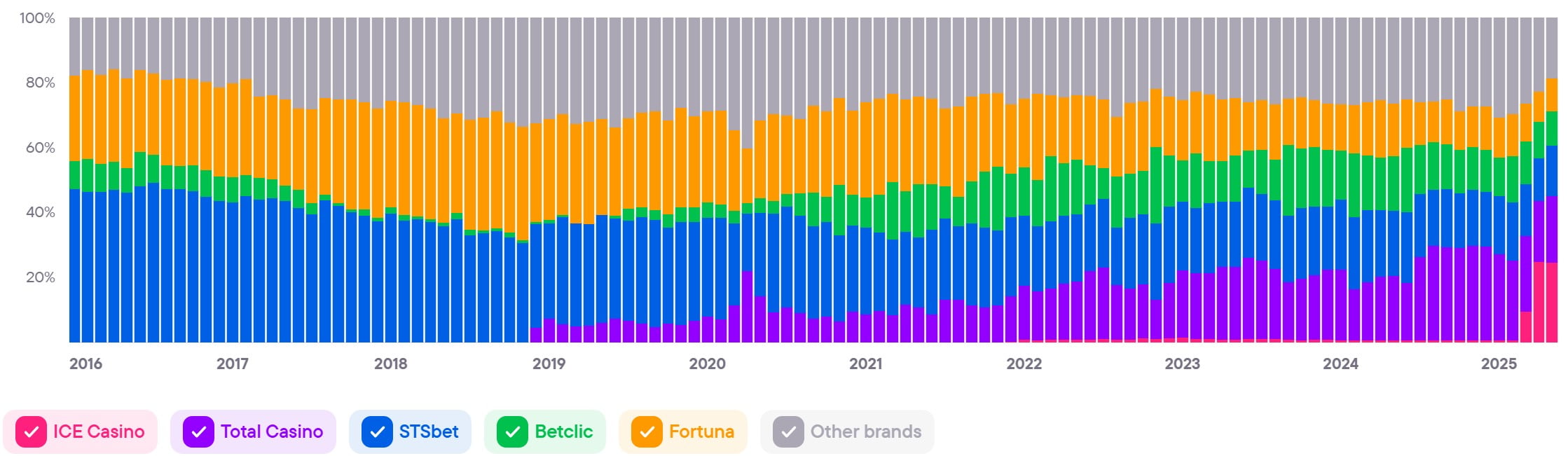

Top brands in the country

| Brands | BAP* |

|---|---|

| ICE Casino | 24,7 |

| Total Casino | 20,5 |

| STSbet | 15,5 |

| Betclic | 10,5 |

| Fortuna | 10,3 |

| Superbet | 4,1 |

- The data for this section was provided by the analytical service Blask.com. Currently, the service's database contains information on 62 countries and more than 2,500 brands. You can view all available countries with Blask statistics at this link.

- Share

- prev

- next