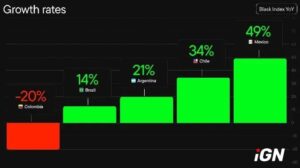

✨ Blask x Growe Partners: Mexico and Chile lead growth among the top 5 LatAm markets in H1 2025g

Analytics platform Blask, in association with Growe Partners, presented data on the top Latin American iGaming markets for H1 2025y based on metrics CEB. The iGN editorial team highlights the following key market dynamics data:

- Brazil (+14% YoY):

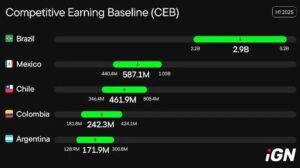

$2.9 billion - CEB

1.18 billion points - Blask Index

501 active brands on the market, 136 with a local license

Over 80% of traffic from mobile devices, 60% of deposits through apps

BAP leaders: Betano and Bet365«

- Mexico (+49% YoY):

$587.1 million - CEB

32.9 million points - Blask Index

104 brand betting casinos

8% - offshore operators market share

1.49 million new users (range 1.12-2.62 million) - APS

BAP leader: «Caliente» (~30%), Betano's growth from 2% to 3.6%

- Chile (+34% YoY):

$461.9 million - CEB

32.4 million points - Blask Index

Offshore operators dominate the local market

BAP leader: Betano (55%), followed by Coolbet and JugaBet«

- Colombia (-20% YoY):

$242.3 million - CEB

71.8 million points - Blask Index

~2% - share of offshore operators (lowest in the region)

2.51 million new users - APS

BAP leader: «BetPlay» (68%), followed by «Rushbet», «Wplay»

- Argentina (+21% YoY):

$171.9 million - CEB

~40% - share of offshore operators (the highest in the region)

2.48 million new users - APS

The casino vertical dominates over betting

BAP leaders: Betsson, bet365, BetWarrior«

Regional Indicators:

$4.4 billion (+22% YoY) - the combined average CEB of the five markets

450 million+ - internet users in five countries

80%+ - use mobile internet access

85% - population lives in urban areas

32-35 years - average age of the population

~95% - literacy level

$9 bln - projected revenue by the end of 2025

1000+ - active brands in the markets

The authors of the study forecast the region's revenue to exceed $9 billion by the end of 2025 on the back of increased mobile access and growth in affiliate marketing.

Activity growth in the region exceeded 20% YoY in H1 2025. Mexico and Chile lead the momentum due to localization and focus on mobile traffic. Brazil remains the largest market (67% of total CEB) and Colombia demonstrates exemplary regulation with the lowest share of offshore operators.