- Information

- iGambling

- Blask

- prev

- next

Gambling regulation

-

Online casino:Illegal

-

Online sports betting:Regulated

-

Gambling in detail:

Population

- Population: 206081432 people.

- Official Language: Portuguese

- HDI: 0,760

- Salary: $418

- Poverty rate: 28%

- Gini: 52.9%

- The believing population: 79%

- Main religion: Christianity (88.9%)

- Second religion: Atheism (7.9%)

Harmful habits

- Alcohol: 6.1 litres/year

- Smoking: 12.8%

Internet

- Internet users: 77.1%

- Mobile Internet: 67.6%

- Landline Internet: 31.7%

- Internet speed: 22.3 Mbps

- Country Top Level Domain: .BR

General information about the country

-

Country name:Brazil

-

Code (2-digit):BR

-

Continent:South America

-

Country level:Tier 2

-

Capital:Brasilia

-

Country area:8511965 sq km.

-

Telephone code:55

-

Currency (code):Brazilian real (BRL)

Geographical features of the country

Administrative division into regions

Federal District: Brasilia.

State (26): Acre, Alagoas, Amazonas, Amapa, Bahia, Goiás, Maranhão, Mato Grosso, Mato Grosso do Sul, Minas Gerais, Para, Paraíba, Paraná, Pernambuco, Piauí, Rio de Janeiro, Rio Grande do Norte, Rio Grande do Norte, Rio Grande do Sul, Rondônia, Roraima, São Paulo, Santa Catarina, Ceará, Sergipe, Tocantins, Espírito Santo.

Features of the country

The modern territory of the country was partially or fully occupied by the following states: the Portuguese Empire, the Spanish Empire, the United Provinces of South America, and the Brazilian Empire.

Brazil has access to the following lakes: Patos, Lagoa Mirin, Tucurui, Mangueira, Kuari, Balbina, Grande de Monte Alegre, Piorini, Uberaba, Itandeua, Tefe, Araruama, Faro, Lagoa Paro, Mamia, Grande Manacapuru, Cabaliana, Mandiore, Itapeva, Lagoa Dos Cuadros and others.

The following rivers flow through the territory: Amazon, Parana, Jurua, Madeira, Purus, Tocantins, São Francisco, Araguaia, Paraguay, Rio Negro, Tapajos, Xingu, Japura, Mamoré, Putumayo, Guaporé, Uruguay, Iguaçu, Rio Grande, Tiete and others.

Brazil has islands: Marajo, Bananal, Tupinambarana, São Luis, Santa Catarina, Ilha Grande, Cardoso, Itaparica, Vitoria, Itamaraca.

Mountains in the territory: Neblina, 31 de Marsu, Bandeira, Calzado, Pedra da Mina, Agulhas Negras, Cristal.

Famous caves in the country: Toca da Boa Vista, Toca da Barriguda, Conjunto Santa Rita, Gruta do Padre, São Vincente, Lapa Terra Ronca, Gruta Olhos d'Agua, Gruta de Tapaham, Gruta do Janelan, Gruta do Centenario, Gruta Casa de Pedra, Abismo Gai Collet, Abismo Ouro Grosso.

Gambling regulation

-

Online casinos:Illegal

-

Online sports betting:Regulated

Read more about regulation

On 1 January 2025, Brazil will launch a regulated iGaming market.

In Brazil, the process of blocking illegal operators is efficiently organised and takes 1-2 days. The SPA sends a request to ANATEL, which then sends lists of illegal domains to more than 21,000 operators and ISPs across the country.

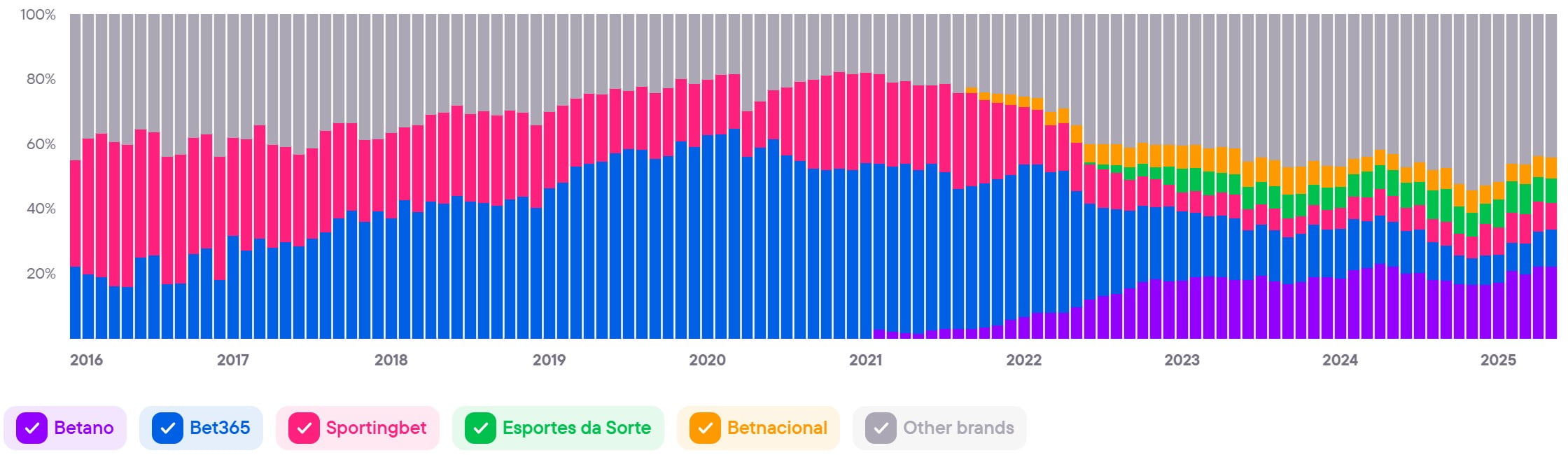

Top brands in the country

Ranking of iGaming brands for January 2025 (Ahrefs)

- Betano (32 700 000)

- Bet365 (21 120 000)

- Betnacional (6 800 000)

- Superbet (4 710 000)

- Sportingbet (4 540 000)

- VaideBet (2 900 000)

- Novibet (2 210 000)

- Blaze (2 160 000)

- Pixbet (1 940 000)

- Onabet (1 650 000)

- KTO (1 620 000)

- Betfair (1 610 000)

- H2bet (1 550 000)

- Bet7k (1 170 000)

- PlayPIX (775 000)

- Parimatch (681 000)

- Esporte da Sorte (668 000)

- Pagbet (552 000)

- Aposta Ganha (543 000)

- F12bet (446 000)

Top payment systems

Top payment methods (October 2024):

- pix

Gambling work files

Online Gambling in the country

How often do Brazilians play at casinos?

- 61% of players log into an online casino at least once a month;

- 30% of players log on to an online casino 1-2 times a week.

Demographics

Players maintain gender parity: 51% female and 49% male.

- 35% of players are between the ages of 25 and 40;

- 28% of players are between the ages of 41 and 56.

Financial situation

- 48% of players are under $1000 per month;

- 40% of players - between $1000 and $3000 per month;

- 12% of players - from $3000 per month.

Regional distribution

Players are present in every state in Brazil. Most of them live in developed cities.

- 24% São Paulo;

- 14% Rio de Janeiro.

What generates interest?

- Lotteries - 58%;

- sports betting - 32%;

- scratch cards - 27%.

How much do they spend per month?

- 63% of players - up to $10;

- 19% of players - $50-$100;

- 18% of players - $100 or more.

Legislation

No matter how you look at it, the country's government has realised the economic benefits of legalising iGaming. In just a few years, bookmakers have become the main entertainment of Brazilians who love football and everything related to it.

The concern of the country's president about the negative consequences of iGaming legalization for citizens is quite justified. For example, the Central Bank presented data according to which the poorest families in Brazil, who receive state benefits to maintain at least a minimum standard of living, spent more than $550 million on betting in August 2024 alone.

Brazil is therefore urgently taking drastic measures in creating a safe environment for local punters. On the one hand, the authorities' actions are generally justified, as they are aimed at protecting the country's citizens.

On the other hand, in this race the officials forget about the no less important participants of this story - the licensees, who cannot calmly wait for the opening of the sector and are constantly on guard in anticipation of new strict and sometimes absurd rules and restrictions. Some of them simply do not see further prospects of their activity and decide to leave the market.

It turns out that the sleeping giant of the world gambling market creates extremely unfavourable conditions for legal operators, clearly contributing to the rapid growth of the shadow sector. Besides, the market is already overcrowded with iGaming-companies, and in such conditions a serious struggle for a place under the sun awaits them.

Gambling affiliate programs with local licence

Gambling affiliate programmes that accept traffic from this country

- Blask data from: 06/03/2025

- Population: 220,050,000 people.

- Population growth rate: 0.61% per year.

- Internet users: 170,100,000 people.

-

Urbanization:

Urbanization — 87.8%

-

Languages in the country:

Portuguese (official)

-

Age structure:

0-14 — 19.6%

15-64 — 69.5%

65+ — 10.9% -

Median age:

Total — 35.1

Male — 34

Female — 36.1 -

Literacy:

Total — 94.7%

Male — 94.4%

Female — 94.9%

-

Real GDP:

2021 — $3.788 trillion

2022 — $3.902 trillion

2023 — $4.016 trillion -

Real GDP growth:

2021 — 4.76%

2022 — 3.02%

2023 — 2.91% -

Real GDP per capita:

2021 — $17,700

2022 — $18,100

2023 — $18,600

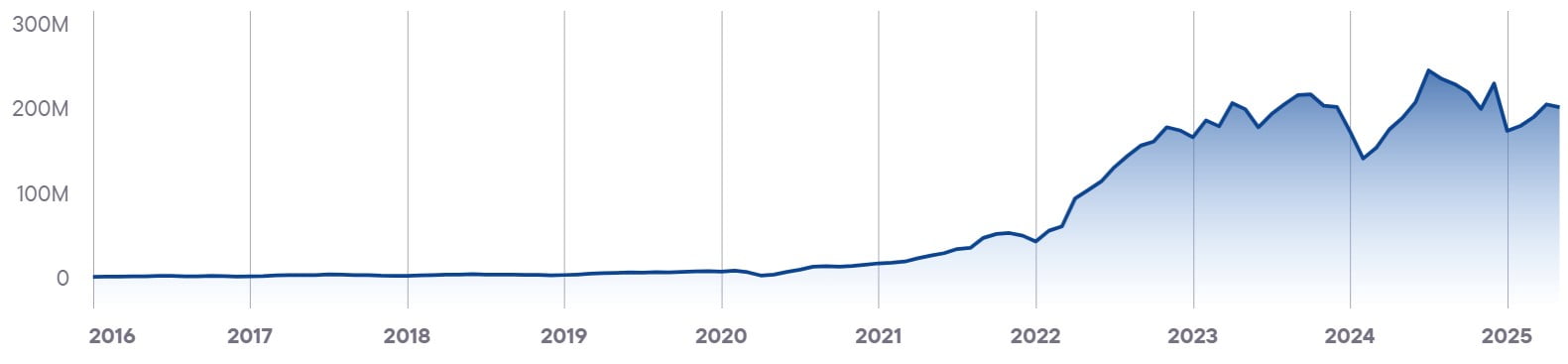

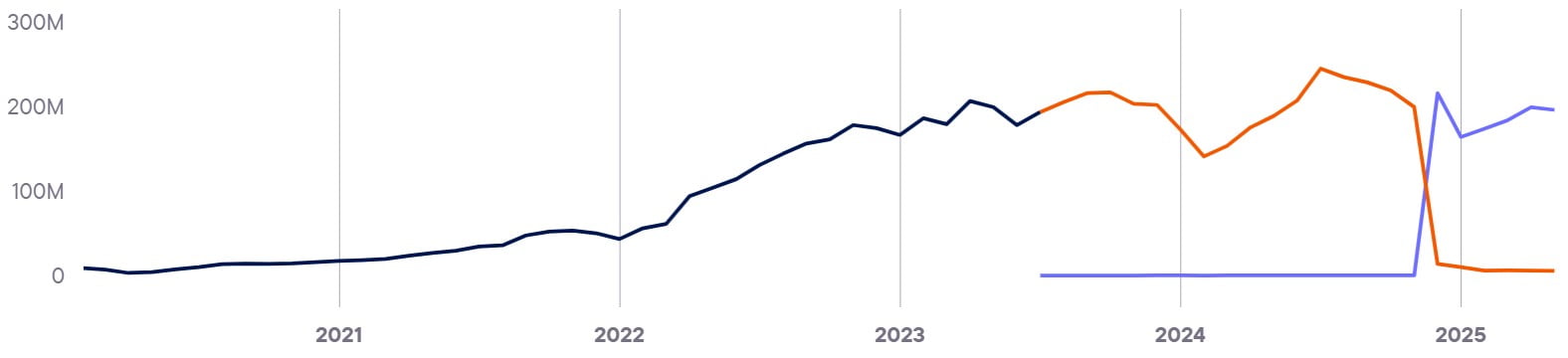

Blask Index

Top brands in the country

| Brands | BAP* |

|---|---|

| Betano | 22,3 |

| Bet365 | 11,4 |

| Sportingbet | 8,3 |

| Esportes da Sorte | 7,5 |

| Betnacional | 6,4 |

- The data for this section was provided by the analytical service Blask.com. Currently, the service's database contains information on 62 countries and more than 2,500 brands. You can view all available countries with Blask statistics at this link.

- Share

- prev

- next